Mortgage borrowing calculator with deposit

At the end of the mortgage term the original loan will still need to be paid back. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the.

Top 20 Mortgage Calculator Tools Startup Stash

Our calculator for professionals is here This one has a range of charts to help you visualise how the table mortgage will pay down over the life of the loan.

. Offset calculator see how much you could save. For an exact quote please contact one of our mortgage brokers by calling 1300 889 743. If applicable please enter the arrangement fee as a percentage this will then be added to the total mortgage facility.

A fixed-rate mortgage means your interest rate will stay the same for the term of the deal. Essentially the higher the interest rate the higher your monthly mortgage payments are likely to be. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend to you.

100k deposit 480k bank valuation 021 x100 for a percentage 21 deposit. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Lenders mortgage insurance calculator Capital gains tax calculator Extra lump sum payment calculator Mortgage repayment calculator Borrowing Power Calculator Income Tax Calculator.

In the US the Federal government created several programs or government sponsored. If you choose to use lenders mortgage insurance to increase your. Is it a.

Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings. The mortgage calculator from Lloyds Bank can help you compare mortgages understand how much you could borrow and what your mortgage repayments would be. Use the home deposit calculator to check if you have enough to pay the upfront costs of buying a home.

Change the deposit you can provide or the amount you want to borrow to see how that affects your result. Our LMI calculator asks for more information than other calculators you may find online. Latest mortgages property news.

With a capital and interest option you pay off the loan as well as the interest on it. How much can I borrow. This is a handy step to take before you contact your mortgage broker so that you can see the effect different interest rates and loan periods will have on the amount of money you can borrow the total interest you pay and your estimated.

Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. The key to maximising your mortgage borrowing power is finding a lender that takes a common-sense approach to your spending. The Bank is not responsible for any reason for any errors in any outcome resulting from the use of the mortgage calculator.

The type of mortgage you choose will determine the type of interest you can expect to pay whether this is a Fixed-rate or Variable. New lender set to launch 50-year fixed-rate mortgage. See how those payments break down over your loan term with our amortization calculator.

Use a mortgage borrowing calculator. Switching to Lloyds Bank. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

Your deposit is the amount of money that you need to put into the mortgage to make up 100 of the final purchase price. They typically request at least 5 deposit based on the value of the property. Affordability calculator get a more accurate estimate of how much you could borrow from us.

Mortgage fees and charges. Your rough mortgage borrowing estimate. If a house is valued at 180000 a lender would expect a 9000 deposit.

Loan Amount Down Payment Loan Term 1 years 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years Additional Months 0 mont. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. The mortgage calculator is only a tool that assists the user arrive at results of various illustrative scenarios generated from data input by the user.

This is another full-function mortgage calculator. Confirming which lendersmortgage insurers are likely to accept your mortgage application. See your total mortgage payment including taxes insurance and PMI.

Most commercial mortgage facilities charge a lender arrangement fee also known as a facility fee acceptance fee or booking fee which is usually a percentage of the mortgage amount being borrowed and added to the facility. In this example the lender would be willing to offer a loan amount of 171000. It takes about five to ten minutes.

A variable-rate mortgage can change month to month so you wont always pay the same amount. And it provides you with a full table of how the payments are applied to both interest cost and principal repayments. You can use our mortgage interest rate calculator to work out how much interest you might pay.

Try our Borrowing Power Calculator and find out how much the banks will lend you for your home loan. Use this mortgage calculator to estimate how much house you can afford. In most cases you will need a minimum of a 5 deposit to secure a mortgage meaning youll need a 95 mortgage loan.

The mortgage amortization schedule shows how much in principal and interest is paid over time. Mortgage interest rates are the additional cost associated with borrowing from a lender to buy a property. Loan to value of.

Existing customer PPI information. Meanwhile some lenders may offer first-time buyers a 100 mortgage with a 0 deposit. In this way it can give a more accurate result by.

A 95 mortgage also known as a 95 loan-to-value LTV mortgage is a mortgage to purchase a property with a small deposit at least 5 but less than 10 deposit of the purchase price. The mortgage should be fully paid off by the end of the full mortgage term. The use of the mortgage calculator is entirely at the risks of the user.

Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. The time it takes to save a 20 deposit has fallen even. We calculate this based on a simple income multiple but in reality its much more complex.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. With an interest only mortgage you are not actually paying off any of the loan. Use our mortgage borrowing calculator to find out how much mortgage you could borrow to buy a property based on your income and whether youre buying with anyone else.

Discount Points Calculator How To Calculate Mortgage Points

Top 20 Mortgage Calculator Tools Startup Stash

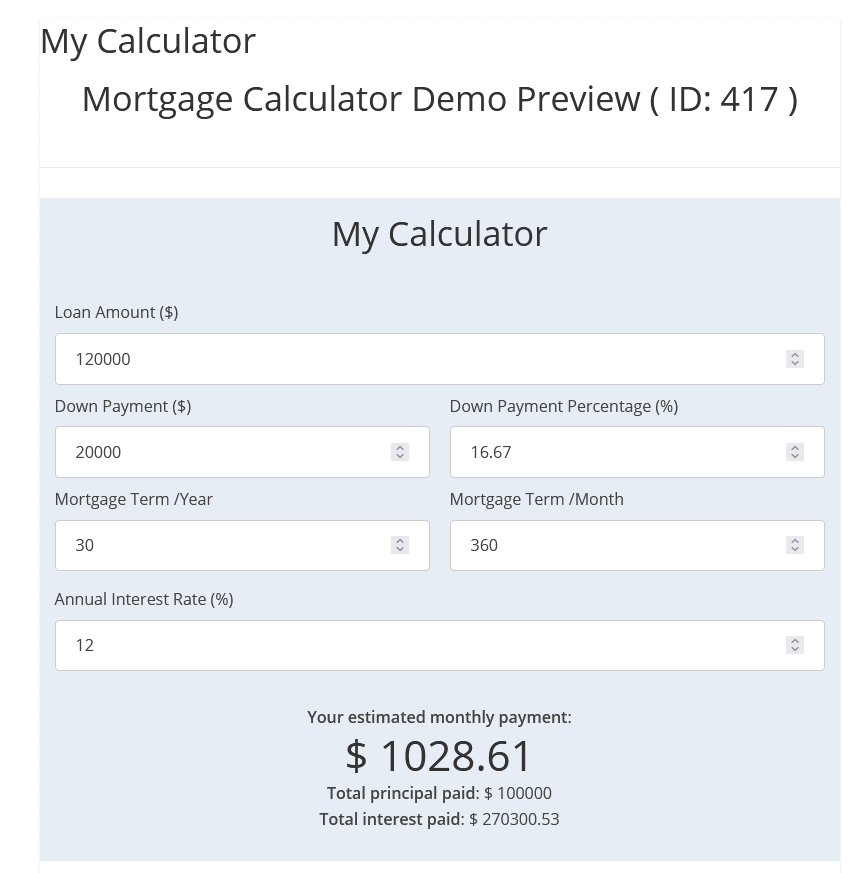

How To Calculate Mortgage On Your Site Using Mortgage Calculator Plugin

Top 20 Mortgage Calculator Tools Startup Stash

Top 20 Mortgage Calculator Tools Startup Stash

Free Mortgage Calculator Free Financial Tools Transunion

Are You Ready To Take Control Of Your Financial Life We Re Here To Help Financial Change Is All Interest Calculator Credit Card Interest Loan Interest Rates

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

Top 20 Mortgage Calculator Tools Startup Stash

Top 20 Mortgage Calculator Tools Startup Stash

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Mortgage Calculator How Much Monthly Payments Will Cost

How To Dodge Mortgage Insurance Fees When Applying For A Home Loan Infographic Mortgage Payment Calculator Mortgage Payment Mortgage

Free Mortgage Calculator Free Financial Tools Transunion

Pin On Finder Money

Mortgage Calculator Money

Mortgage Calculator How Much Monthly Payments Will Cost